Compound interest is a financial term it pays to know.

Understanding compound interest and how to calculate it will help freelancers and small business owners stay in tune with their growing accounts.

What is Compound Interest?

Compound interest is the interest earned from the original deposit plus accumulated interest.

When you start generating income with your small business, understanding compound interest is an essential key in keeping your accounting in check-- whether you’re considering a small business loan, or you’re looking to maximize your investments.

Breaking Down Compound Interest:

- If you deposit a sum of $100 into a business account with a 5% interest rate, at the end of that year you will collect $5 on that initial deposit. ($100 + 5%)

- Now you have $105 and as another year goes by you will be gaining interest on the full amount. ($105 + 5%)

- By the end of year two, you’ll have made an additional 5% interest on top of the initial $5 interest, bringing you to $110.25. (the compound interest is the additional $0.25)

You’re not just earning interest on your initial deposit, you’re earning an additional interest on top of that.

Likewise, if you are borrowing money, compounding interest is working in favor of the bank or lender you borrowed from.

High interest rate = higher compound interest

What Collects Compound Interest?

Any funds or accounts that continuously build interest have the opportunity to compound interest.

Examples of compoundable interest accounts include:

- Money market accounts

- Retirement savings accounts

- Interest-based advertising

- High-yield savings accounts

- Mortgage Loans

- Business loans

- Credit card debt

How to Create Powerful Compounding

Compound interest increases as you continue to build interest on an amount. The first few cycles of funds may not be significant but the longer you build interest, the more compounding occurs.

Key elements for powerful, continuous compounding:

- Initial deposit

- The larger the amount that you initially invest, the more you're going to have to build off of. Consolidating your funds into one account will increase your return.

- Interest Rate

- Some banks and investment accounts have lower interest rates but will give you more flexibility with your initial deposit. Banks with a higher or faster rate tend to charge more fees and have limitations on access to your funds. Weigh your options and choose the right balance.

- Frequency of Compounding

- Frequent compounding periods will generate more growth. Some banks (even online banks) cycle on a daily basis, while others may cycle monthly. The more that your funds are being cycled, the more they’re gaining interest and in turn, compound interest.

- Compounding Period

- Take into consideration how long you plan on letting your funds sit and grow. If you make too many withdrawals, your interest rate will dramatically slow down and it will take longer to see compound interest compiling. The longer you can keep your funds in, the more you’ll reap the benefits.

- Regular Deposits

- The more consistent you are with your deposits, the more progress you’ll see in your account. Whether you’re making monthly deposits or an occasional additional deposit, growing your account will expedite your returns.

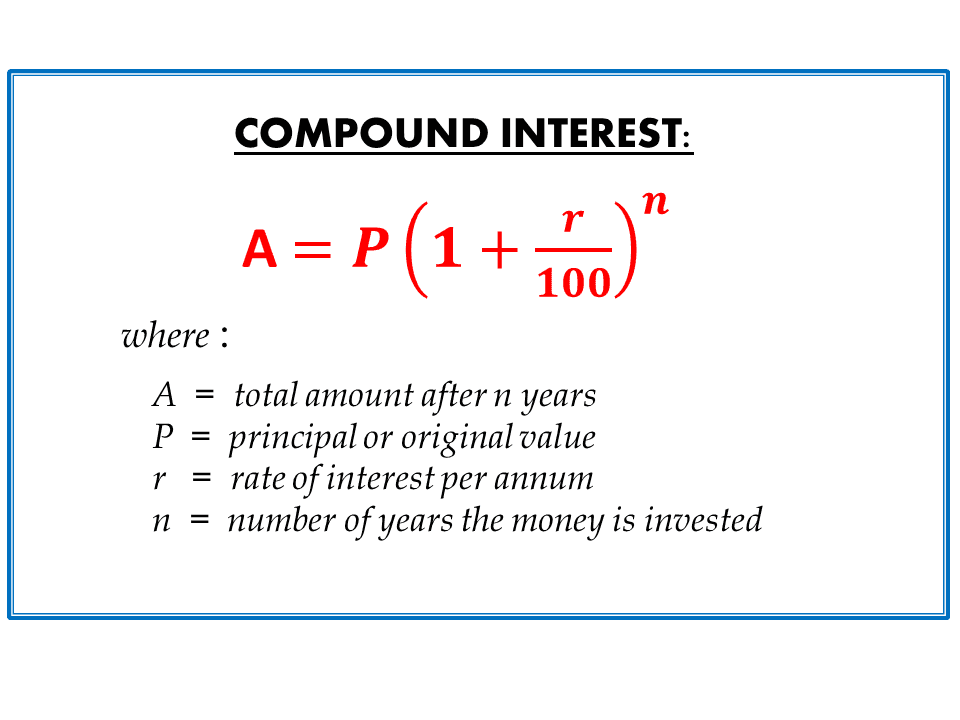

Calculating Compound Interest

Learning how to calculate compound interest will give you valuable insight on how to maximize your return.

Once you know which financial institute you want to have your account with, and how much you plan to deposit, you can calculate how much money you will make on your funds as interest compounds.

Using a financial calculator such as a Compound Interest Calculator is the quickest and simplest way to know right away how much you’ll be gaining on your initial investment. However, if you prefer to calculate manually, there is a compound interest formula:

However you prefer to calculate your rate of return, having an idea of what to expect from your investments will only encourage you to be consistent and patient as interest compounds.

Key Takeaways

Whether you're trying to save, consolidate debt, or make the most of your investments, by knowing how to calculate compound interest you’re gaining valuable tools to maximize your returns and expedite your financial goals.

- Compound interest is compounding off the interest from the initial deposit

- One deposit alone can start compounding interest

- Loans build compound interest just as investments do

- Compounding frequency makes a difference (daily compounding vs annual compounding)

- Long-term investments will maximize the rate of return