A part of the sales tax report, the sales tax summary report displays the total net sales tax that has been paid by the business in a period of time. The report includes the value of taxes that you’ve collected along with the taxes that you’ve paid on expenses.

What Is a Sales Tax Summary Report?

The report shows a line-by-line breakdown of your sales tax return and the contributing transactions. The sales tax summary report can help you identify any delinquent transactions that affect your sales tax reporting and also help your tax preparer file your returns.

The sales tax is a form of tax that is added to the purchase and sale of goods and services. Businesses have to report the tax to the Internal Revenue Service. Creating a sales tax summary makes it easier for the tax professionals while filing the tax returns.

What Is Included in a Sales Tax Summary?

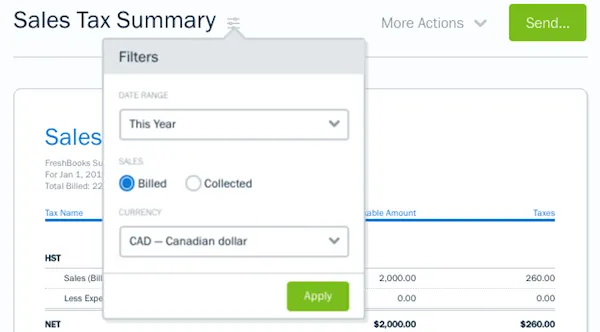

At the top of a sales tax summary report, you have your personal business information along with the Total Billed or Total Collected amount. This displays the total value (including the taxes) you invoiced or collected during a particular period of time.

The row headers are populated by the tax names.

The two numerical columns in the report are:

- Taxable Amount - The total invoice amount on which tax was applied

- Taxes - The amount of tax that was applied

This is the same for the Less Expenses line:

- Taxable Amount - The total expenses, before tax, that tax was applied to

- Taxes - The taxes paid on expenses

If you’re using an accounting software for invoicing and payments, creating a sales tax summary is easy. You can customize the report by adding filters to change the date range, sales (billed or collected) and currency. Moreover, depending on the status of the report, you can print, edit, send or export the tax summary report.

Source: https://support.freshbooks.com/hc/en-us/articles/219103028-What-is-a-Sales-Tax-Summary-Report-

Ideally, the total amount that is billed or collected along with the amount of tax applied should equal the gross amount billed or collected. If the amounts don’t match, it means that one of the invoices in the particular date range does not have taxes applied to it.

Before creating the sales tax summary report, you should check with a local tax authority or a tax accountant to ensure that your clients are being charged the correct sales tax rates and to make sure you file and remit the sales taxes correctly.