Additional Paid-In Capital: Definition, Formula & Example

Investments and stocks can be incredibly complicated.

When you’re valuing a stock, you want to always make sure that you can be as accurate as possible. This is what’s known as the par value of a stock. It’s the baseline of what the stock is worth. Anything that’s above that value is known as additional paid-in-capital (APIC).

But what exactly is APIC?

We’ll take a closer look at the definition, the formula used, and an example of additional paid-in capital.

Table of Contents

KEY TAKEAWAYS

- Additional Paid-In Capital is the calculated difference between the par value of common or preferred stock and the price paid for it.

- This is also known as contributed capital in excess of par, or capital surplus.

- APIC is usually put under shareholders’ equity on a business’s balance sheet.

- It is a great way to generate cash for businesses without first laying down any collateral.

What Is Additional Paid-In Capital?

Additional Paid-In Capital is the calculated difference between the par value of common or preferred stock and the price that is paid for it. It occurs when newly-issued shares are bought by an investor directly from a business. It happens during its initial public offering (IPO) stage. APIC is usually put under shareholders’ equity on a business’s balance sheet. The sum of cash that is generated by the IPO is recorded as a debit. The common or preferred stock and the APIC would be recorded as credits.

It is a great way to generate cash for businesses without first laying down any collateral.

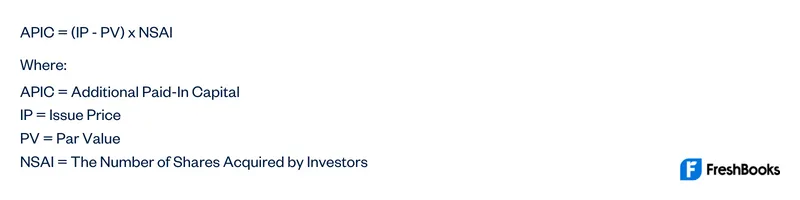

What Is the APIC Formula?

The formula that can be used to calculate APIC is as follows:

What Is an Example of APIC?

Let’s say that Company X issues 20,000 of new stocks. These are valued at $5 per share. The par value of the stock is $0.01. With this information, we can calculate the APIC of the stock:

APIC = ($5 – $0.01) x 250,000

So:

APIC = $99,800

This transaction would be booked by the following Journal Entry:

Cash $100,000

Common Stock $200

APIC $99,800

What Is Par Value?

APIC represents the amount of money that is paid to the company that is above the par value of the stock. It’s also important to fully understand what par value means.

The word ‘Par’ comes from Latin. It means equal or equality. In this case, it signifies the face value that a business gives to a particular stock during its IPO. This is valued before there is a market for the stock. The Par Value is printed on the stock certificate.

If a stock drops below its par value, then potential legal liability may occur. This often leads to companies trying to avoid this by setting their stock par values far lower than their actual worth.

What Is Market Value?

The par value is the value set by the business before the stock hits the market and the market value is the value set by the open market.

The market value is the actual price a financial instrument is worth and the cash amount it will be sold for. This is because the stock market decides the real value of a stock. The difference between the market and the par value creates Additional Paid-In Capital.

Summary

Additional paid-in capital is the difference between a share’s printed value and the amount the share is sold on the market. Additional Paid-In capital is only created when a company sells the shares at the Initial Public Offering (IPO).

FAQs on Additional Paid-In Capital

Yes, there is a difference between paid-in capital vs additional paid-in capital. Paid-in capital is the total amount of money or assets a company has received from shareholders to purchase stock. Additional paid-in capital is the amount a business receives for a stock purchase that is in excess of the stock’s par value.

The sum of cash that is generated by the IPO is recorded as a debit on the balance sheet.The common stock and the APIC would be recorded as credits.

Additional Paid-In Capital would increase if more shares are sold. Additional Paid-In Capital would decrease, if the company buys back the shares at a higher amount than initially sold during IPO. There isn’t any change in the APIC when a company’s shares are traded on a secondary market. This is because the amounts that are exchanged during the second transaction don’t involve the company that first issued the shares.

Share: