🌟 KEY TAKEAWAYS

Contributed capital can also get referred to as paid-in capital. It’s the cash and any other assets that shareholders provide a company, and in exchange are given ownership or stock.u0026nbsp;

Essentially, contributed capital is the total price that a shareholder pays to get a stake in a company in return.u0026nbsp;

Contributed capital ends up being reported on a company’s balance sheet under the shareholder’s equity section. It’s often recorded to the common stock account, with any additional contributions received that is above the par value of shares recorded in the u0026nbsp;Additional Paid-in Capital account.

It’s important that you can make your way around your balance sheet as there is a lot of vital information on there that is pertinent to you and your business.

One of the pieces of information that you need to take into consideration is your contributed capital.

What Is Contributed Capital?

Contributed capital refers to any cash or other assets that shareholders have provided to a company. It can commonly get referred to as paid-in capital, and the cash or assets that are provided are in exchange for company stock.

When a company issues new equity shares, investors make capital contributions that are based on the price shareholders are willing to pay for them. The total amount of contributed capital, or paid-in capital, that an investor makes determines the total ownership or stake that they have in the company.

Contributed capital is a balance sheet item of a company. It gets listed under the Shareholders’ Equity section. Sometimes, shareholders might contribute cash or assets over and above the par value of the company’s shares and that is commonly referred to as additional paid-in capital, which is also listed under the Shareholders’ Equity section after the other Contributed Capital.

When you hear the term contributed capital, it refers to any shares that investors have purchased directly from a company. This can either be from a secondary issuance of stock or from an initial public offering. The accounting entry for the contributed capital are to debit cash or asset and credit Shareholders’ Equity, reflecting the increase in assets and balance owed to shareholders.

The Contributed Capital Concept

When a company issues new stock, contributed capital is the total value that shareholders have paid for that stock. This can come from a few different avenues, including direct listings, direct public offerings, initial public offerings (IPOs), and secondary offerings. It also included any issues of preferred stock.

As well, the receipt of any fixed assets in exchange for stock is also included, as is the reduction of a liability in exchange for a stock. You can compare contributed capital with additional paid-in capital. The difference you find between these two values will equal the premium that’s paid by investors, which will be above the par value of the company shares.

The par value is an accounting value, and it relates to each of the offered shares and isn’t the same as the market value that investors pay. Preferred shares can often have par values that are higher than marginal. Yet, most common shares that are available today have a par value that’s extremely low. This is why additional paid-in capital can sometimes be separate on the balance sheet of a company.

Formula for Contributed Capital

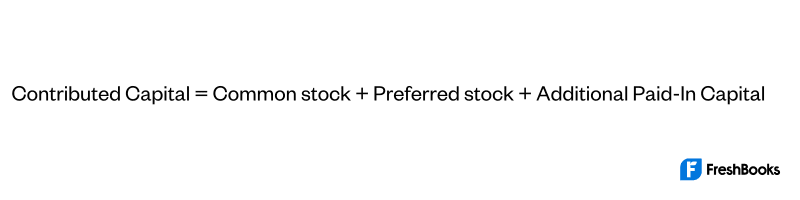

Contributed capital gets reported on the balance sheet of a company in the shareholder’s equity section. Here, it’s divided into two separate accounts, which are the additional paid-in capital account and the common stock account.

Common stock is the total of par value of any issued shares from the company. This appears on the balance sheet as preferred stock and common stock. Additional paid-in capital refers to any money that has been paid by shareholders that is above the par value.

The formula for calculating contributed capital would look like the following:

Capital Contributions

It’s worth looking further into capital contributions and exploring the fact that they can come in multiple forms aside from the sale of equity shares. A capital contribution is essentially an injection of cash into a company.

For example, business owners will often take out some type of business loan from a lender or financial institution and then use the proceeds to make a capital contribution back to their company.

As well, a business can receive a capital contribution in other forms, such as non-cash assets like equipment and buildings. When these scenarios of capital contributions occur, they ultimately increase the equity that an owner has.

Example of Contributed Capital

Let’s say that a company decides to issue 10,000 par value shares to its investors for $1 per share. The investors end up paying $10 per share which provides the company with $100,000 in equity capital.

From this, the company would end up recording $10,000 to its common stock account and $90,000 to its Additional Paid-in Capital in excess of par. When these accounts are added together, they equal the total amount that the stockholders were willing to pay for the purchase of their shares.

Ultimately, this means that the contributed capital would equal $100,000.

Advantages and Disadvantages of Contributed Capital

There can be a few advantages and disadvantages of contributed capital that are worth exploring and understanding a little bit more. Here are a few of the most common to be aware of.

Advantages

- There is no collateral — When there are equity shares issued, investors don’t ask for any collateral in return. As well, existing assets also remain free which can then be used if needed.

- There are no restrictions — There aren’t any restrictions on the use of funds when it comes to contributed capital. In other cases, lenders can establish financial covenants which put restrictions on the way that funds can be used.

- There isn’t a fixed payment burden — No matter the amount received in the form of contributed capital, it won’t increase the fixed cost or even the fixed payment burden the company has.

Disadvantages

- Dilution of ownership — When investors receive an equity stake in a company, they also get certain governance rights. This relates to the election of a board of directors as well as other business decisions.

- No guaranteed return — Even if there is contributed capital, an investor isn’t guaranteed any dividends, growth, or profits in return. As well, the returns they might receive become even more uncertain compared to debt holder returns.

Summary

Contributed capital is also referred to as paid-in capital. It refers to any cash and assets that a shareholder provides to a company in exchange for stock. If a company issues equity shares, then investors can make capital contributions that are based on the price a shareholder is willing to pay for them.

Contributed capital gets reported on the balance sheet of a company in the shareholder’s equity section. This is often split into two separate accounts, which include the common stock account and the additional paid-in capital account.

FAQs About Contributed Capital