Yield Equivalence: Definition, Formula & Types

The interest rate on a taxable asset that would produce a return equal to that on a tax-exempt investment, and vice versa, is known as the yield equivalency rate.

Read on as we take a closer look at exactly what yield equivalence is, how to calculate it, and what the different types of yield equivalence are.

Table of Contents

KEY TAKEAWAYS

- The interest rate on a taxable asset that would produce a return equal to that on a tax-exempt investment, and vice versa, is known as the yield equivalency rate.

- Investors in municipal bonds should consider yield equivalency. This is if they want to know if the lower yields of their bonds will be offset by the lower tax savings. This is when compared to similar duration taxable securities.

- Investors should be cognizant of the current tax rates when determining the yield equivalent between tax-free and taxable investments.

What Is Yield Equivalence?

Yield equivalence is a taxable security’s interest rate that would produce a return equal to a tax-exempt security’s return, and vice versa.

Investors in municipal bonds should consider yield equivalency because they want to know if the lower yields of their bonds will be offset by the lower tax savings compared to similar duration taxable securities. When seeking to determine if they would receive a better return from a tax-exempt or tax-free investment than they would from a taxable option, investors sometimes utilize the average yield equivalence comparison.

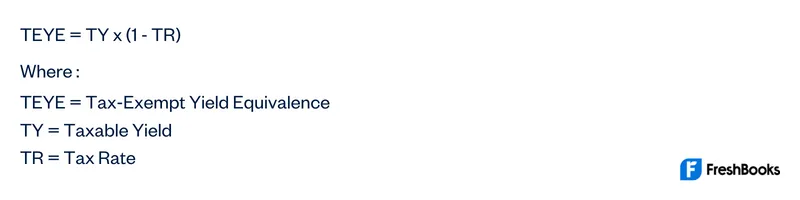

Formula to Calculate Yield Equivalence

Yield equivalence can be calculated by using the following two formulas:

and

What Are the Types of Yield Equivalence?

There are three different types of yield equivalence curves. They are as follows:

- A Normal Yield Curve: The yields on longer-term bonds may continue to climb in response to periods of economic boom. This is according to a normal or upward-sloping yield curve.

- An Inverted Yield Curve: A yield curve that has been inverted shows that short-term rates are higher than long-term rates and slopes downward. When investors anticipate greater drops in rates on bonds with longer maturities, this type of yield curve is linked to economic downturns.

- A Flat Yield Curve: A flat yield curve is indicated by similar yields across all maturities. It’s possible that a few intermediate maturities have somewhat higher yields than the average, which causes a little hump to appear on the flat curve. The mid-term maturities, or those between six months and two years, are often affected by these obstacles.

How to Calculate Tax Equivalent Yield (TEY)

The yield on a tax-exempt bond is multiplied by one less than the investor’s federal income tax bracket to arrive at the tax-equivalent yield. For instance, the tax-equivalent yield would be determined as follows if an investor in the 32.0% federal income tax bracket wanted to compare a taxable bond with a 4.0% yield to a tax-exempt bond with a 3.5% yield:

3.5%/(1-0.320) = 3.5%/0.680 = 5.15%

How to Calculate Bond Equivalent Yield (BEY)

By dividing the difference between the bond’s face value and its purchase price by the bond’s price, the bond equivalent yield is computed. The number of days until the bond’s maturity, “d,” is then subtracted from the result after being multiplied by 365.

Consider that Investor X pays $9,000 for a $10,000 zero-coupon bond and anticipates receiving the whole amount in six months. The investor would receive $1,000 in this scenario. BEY is calculated by deducting the bond’s real purchase price from its face value (par):

$10,000 – $9,000 = $1,000

The return on investment is then calculated by dividing $1,000 by $9,000, which is 11%. By multiplying it by 365 divided by the number of days left until the bond matures, which is half of 365, the second part of the formula annualized 11%. Thus, multiplying 11% by 2 results in a bond equivalent yield of 22%.

Summary

Yield equivalence is a useful tool when looking at interest rates on a taxable asset. It’s important to fully understand what the interest rates are on a taxable asset in order to avoid any fines for a mispayment.

It’s crucial to remember that beginning in 2018, adjustments to income brackets and marginal tax rates were made as a result of the Tax Cuts and Jobs Act, which was passed in late 2017. As a result, be sure your knowledge of tax laws is current.

FAQS on Yield Equivalence

No, yield to maturity is not the same as bond equivalent yield. The yield to maturity, which accounts for both principal and coupon returns, is the annual rate of return on investment in bonds. The bond equivalent yield, on the other hand, simply takes the principal return into account.

Securities with a single payment only pay interest once, at maturity. The stated single-payment yield must be transformed into a bond equivalent yield in order to compare single-payment yields with bond equivalent yields.

By multiplying the difference between the yields by the fraction obtained by dividing the term’s value by the combined capital value and deducting the result from the larger yield, one can obtain an initial approximation of the equivalent yield on commercial property.

Equated yield is a growth explicit cash flow’s internal rate of return. An equivalent yield is a single yield that can be utilized to capitalize both reversionary and term incomes.

Share: