🌟 KEY TAKEAWAYS

Discounted payback period refers to how long it takes to recoup your original investment.

Discounted payback period accounts for money’s time value, which makes it a more accurate metric than the regular payback period.

To calculate discounted payback period, you need to discount all of the cash flows back to their present value.

A prime example of this is the discounted payback period. Essentially, you can determine how long you’re going to need until your original investment amount is equal to other cash flows. Read on to learn more about how discounted payback period works. We will also cover the formula to calculate it and some of the biggest advantages and disadvantages.

What Is a Discounted Payback Period?

Discounted payback period refers to time needed to recoup your original investment. This includes interest, using a discounted cash flow. In other words, it’s the amount of time it would take for your cumulative cash flows to equal your initial investment.

The payback period value is a popular metric because it’s easy to calculate and understand. However, it doesn’t take into account money’s time value, which is the idea that a dollar today is worth more than a dollar in the future.

Discounted payback period does account for money’s time value, which makes it a more accurate metric.

To calculate discounted payback period, you need to discount all of the cash flows back to their present value. The present value is the value of a future payment or series of payments, discounted back to the present.

You can think of it as the amount of money you would need today to have the same purchasing power as a future payment.

How to Calculate Discounted Payback Period

Discounted payback period refers to the number of years it takes for the present value of cash inflows to equal the initial investment.

Discounted payback period serves as a way to tell whether an investment is worth undertaking. The lower the payback period, the more quickly an investment will pay for itself.

To calculate discounted payback period, you will need to know the following:

- The initial investment

- The cash inflows for each year of the investment

- The discount rate

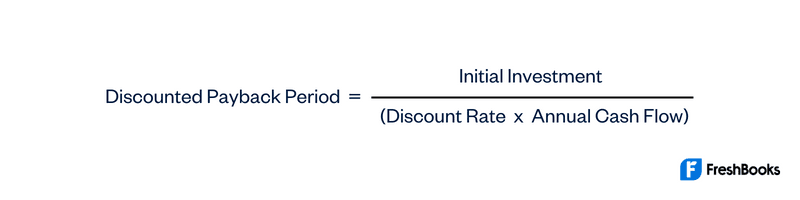

Once you have this information, you can use the following formula to calculate discounted payback period.

Discounted Payback Period Formula

Discounted payback period calculation is:

For example, let’s say you have an initial investment of $100 and an annual cash flow of $20. If you’re discounting at a rate of 10%, your payback period would be 5 years.

To calculate the payback period using Excel, you can use the PV function. For our example, the formula would look like this:

PV(10%,5,-100,-20)

This would give you a payback period of 5 years.

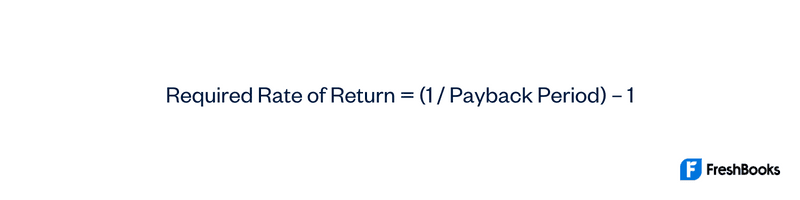

You can also use the payback period formula to calculate the required rate of return. This is useful if you’re trying to decide if a project is worth your investment. The required rate of return is the minimum rate of return that you would accept for an investment. To calculate the required rate of return, you would use this formula:

For our example, the required rate of return would be 20%. This means that you would only invest in this project if you could get a return of 20% or more.

Advantages of Discounted Payback Period

The main advantage is that the metric takes into account money’s time value. This is important because money today is worth more than money in the future. The discount rate represents the opportunity cost of investing your money.

With positive future cash flows, you can increase your cash outflow substantially over a period of time. Remember that the cost of capital changes from its initial cost. Depending on the time period passed, your initial expenditure can affect your cash revenue.

If you have a cumulative cash flow balance, you made a good investment. Thus, you should compare your year-end cash flow after making an investment.

Another advantage of this method is that it’s easy to calculate and understand. This makes it a good choice for decision-makers who don’t have a lot of experience with financial analysis.

Disadvantages of Discounted Payback Period

Discounted payback period calculation is a simple way to analyze an investment. However, there are some limitations to this method. One limitation is that it doesn’t take into account money’s time value. This means that it doesn’t consider that money today is worth more than money in the future.

Another limitation is that it only looks at the cash flows from the project. It doesn’t consider other factors such as risk or profitability.

Despite these limitations, discounted payback period methods can help with decision-making. It’s a simple way to compare different investment options and to see if an investment is worth pursuing.

Discounted Payback Period Example

Let’s say you’re considering investing in a new project. The project has an initial investment of $1,000 and will generate annual cash flows of $200 for the next 5 years. The discounting of cash flows rate is 10%.

The payback period measure for this project is 4.17 years. This means that it will take 4 years and 2 months to recoup your initial investment.

The required rate of return is 19.6%. This means that you would need to earn a return of at least 19.6% on your investment to break even.

Now let’s say you’re considering investing in a different project. The project has an initial investment of $1,000 and will generate annual cash flows of $100 for the next 10 years. The discount rate is 10%.

The payback period for this project is 10 years. This means that it will take 10 years to recoup your initial investment.

The required rate of return is 9.1%. This means that you would need to earn a return of at least 9.1% on your investment to break even.

As you can see, the required rate of return is lower for the second project. This means that it’s a better investment.

Summary

Discounted payback period process is a helpful metric to assess whether or not an investment is worth pursuing.

When using this metric, it’s important to keep in mind that a longer payback period doesn’t necessarily mean an investment is bad. You should also consider factors such as money’s time value and the overall risk of the investment.

FAQs About Discounted Payback Period