Tax Deduction for Legal Fees: Is Legal Fees Tax Deductible for Business?

Legal fees are tax-deductible if the fees are incurred for business matters. The deduction can be claimed on business returns (for example, on Form 1065 for a partnership) or directly on the Schedule C of personal income tax returns.

The Internal Revenue Service allows individuals and businesses to claim as a business expense the money they pay for certain professional services, which includes legal expenses. However, to be eligible for deductions, the legal fees must be directly related to your business operations or be a part of acquisition costs which may include legal expenses to start or buy a business.

What this article covers:

- Can You Write off Legal Fees?

- Can You Write off LLC Fees?

- Can You Write off Tax Preparation Fees?

- Can You Write off Licensing Fees?

- Can You Write off Online Classes on Your Taxes?

Can You Write off Legal Fees?

Legal fees that are ordinary and necessary expenses and that are related to running your business can usually be a deductible business expense. To assess if you can write off legal fees, you need to consider the nature of the legal expense.

Personal Legal Fees

The general rule is that the business-related legal expenses are tax-deductible. Legal fees related to personal issues are generally not deductible. There are certain exceptions, including legal expenses that were incurred from your trade or business.

Business Legal Fees

According to the IRS, the legal fees incurred by a taxpayer in the course of a trade or business are generally deductible if they are ordinary and necessary expenses of the business.

Some instances where you can claim tax deductions for business expenses are:

- Attorney fees, court costs, and similar expenses if these costs are incurred during the production or collection of taxable income

- The legal fees connected with the bankruptcy of a business are deductible

- Legal fees linked to handling, protecting or maintaining income-producing property are usually tax deductible

- The attorney fees that are charged for defending and filing damage suits in a business are deductible

- Legal fees incurred to defend against criminal charges related to a taxpayer’s trade or business are deductible. However, legal fees for defending criminal charges against an individual is not tax deductible

The deduction of legal expenses in the tax year depends on which accounting method you use. For example, if you use the cash accounting method, you claim legal expenses as business expenses in the year in which you actually pay the expense while under the accrual accounting method, you can claim the expense when the lawyer provides the service or when you pay for it.

While some legal fees can be deducted on business schedules and provide the maximum benefit, others have to be deducted as miscellaneous itemized deductions, the total of which is subject to a 2% of AGI deduction floor.

Can You Write off LLC Fees?

The owners of a limited liability company (LLC) can deduct a certain amount of start-up and organizational expenses incurred by the business. This is irrespective of how the LLC is designated in terms of its tax structure.

To claim this business tax deduction, an LLC has to incur start-up costs before it formally begins its operations. These start-up costs include the costs associated with investigating or actually purchasing an LLC, marketing expenses, travel costs etc.

Once the business is officially open, ongoing costs can be written off as well under the category of operating business expenses.

Can You Write off Tax Preparation Fees?

The IRS allows business owners to deduct tax preparation fees as a business expense.

This is limited not just to the expenses of hiring a tax professional prepare your return but also expenses related to the purchase of tax software and tax-related books, legal fees for representation in tax audits, advice on tax planning, collections and criminal investigations.

Can You Write off Licensing Fees?

Like many deductions, you can write off license fees and expenses if they qualify as a business expense. For example, a lawyer must pay an annual licensing fee to remain licensed in the state. This fee can be written off.

License fees for personal purposes such as pet licensing fees and marriage licenses are generally are not allowed as a tax deduction.

Can You Write off Online Classes on Your Taxes?

If you pay or reimburse any education expenses for your employees, you can generally include that as a tax deduction on your tax return. Generally included is the cost of books, equipment, fees, tuition, and supplies.

If you’re still concerned about whether you’ll be able to deduct legal fees, ask your attorney if any of the fees he or she will charge will be tax deductible. You could also ask your attorney to prepare a billing a statement that shows clearly what part of the fees is deductible.

RELATED ARTICLES

Business Deductions: New Tax Plan Explained

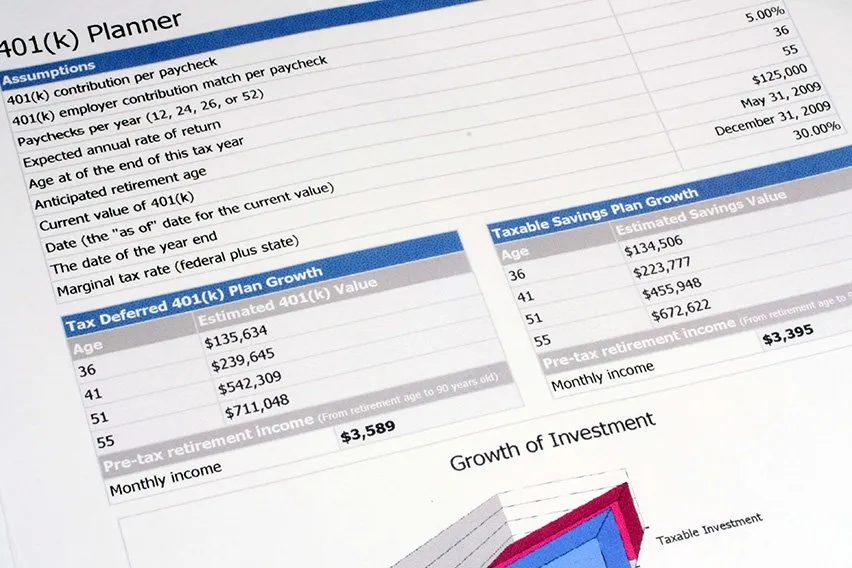

Business Deductions: New Tax Plan Explained How to Set Up a 401(k) in 4 Easy Steps (For Small Business)

How to Set Up a 401(k) in 4 Easy Steps (For Small Business) Can You Write-Off Expenses Before Incorporation? Certain Expenses, Yes

Can You Write-Off Expenses Before Incorporation? Certain Expenses, Yes Can You Write-Off Nanny Expenses? Yes, Here’s How

Can You Write-Off Nanny Expenses? Yes, Here’s How Can You Write-Off Relocation Expenses? Only U.S. Armed Forces Can

Can You Write-Off Relocation Expenses? Only U.S. Armed Forces Can Tax Deductions for Daycare Business: Top 10 Deductions

Tax Deductions for Daycare Business: Top 10 Deductions