Closing Entry Definition, Types & Examples

It’s vital in business to keep a detailed record of your accounts.

At the end of a financial period, businesses will go through the process of detailing their revenue and expenses. They will then close their accounts. This is where closing entries come into play.

But what exactly is a closing entry?

Read on as we give you a detailed definition and answer some common questions.

Table of Contents

KEY TAKEAWAYS

- A closing entry is an entry made in a journal. It is done when an accounting period comes to an end.

- The process involves moving data from a temporary account on the income statement. It is moved to permanent accounts on the balance sheet.

- Eventually, all income statement balances are then transferred to retained earnings.

What Is a Closing Entry?

A closing entry is an entry made in a journal. Made at the end of an accounting period, it transfers balances from a set of temporary accounts to a permanent account. Essentially resetting the account balances to zero on the general ledger.

A business will use closing entries in order to reset the balance of temporary accounts to zero.

There may be a scenario where a business’s revenues are greater than its expenses. This means that the closing entry will entail debiting income summary and crediting retained earnings. But if the business has recorded a loss for the accounting period, then the income summary needs to be credited. Then the retained earnings will be reduced through a debit.

How to Record a Closing Entry

There are four steps commonly used to record a journey entry. These steps make up the entire closing process:

Step 1: Transfer Revenue

All revenue accounts are first transferred to the income summary. This can be done by making a journal entry. Here you will focus on debiting all of your business’s revenue accounts. You will also credit the income summary.

Step 2: Transfer Expenses

The next step is to repeat the same process for your business’s expenses. All expenses can be closed out by crediting the expense accounts and debiting the income summary.

Step 3: Close and Credit

The third step is to close the income summary account. Once this is done, it is then credited to the business’s retained earnings.

Step 4: Transfer Balance

The final step is to transfer any remaining balance. In this case, if you paid out a dividend, the balance would be moved to retained earnings from the dividends account. Once this has been completed, a post-closing trial balance will be reviewed to ensure accuracy.

Examples of Closing Entries

Using the above steps, let’s go through an example of what the closing entry process may look like.

In this example, the business will have made $10,000 in revenue over the accounting period. Within this time it will have also incurred expenses of $9,000. In this example, it is assumed that there is just one expense account.

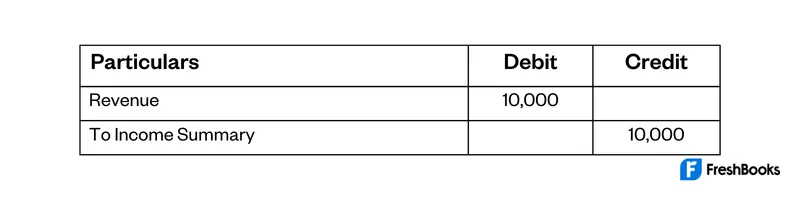

Step 1: Transfer Revenue

The $10,000 of revenue generated through the accounting period will be shifted to the income summary account.

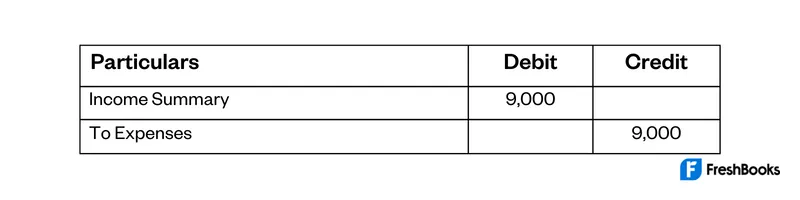

Step 2: Transfer Expenses

The $9,000 of expenses generated through the accounting period will be shifted from the income summary to the expense account.

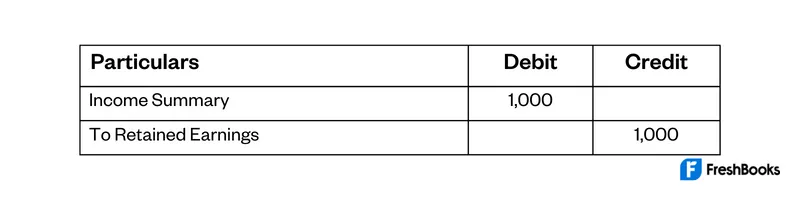

Step 3: Close and Credit

The $1,000 net profit balance generated through the accounting period then shifts. This is from the income summary to the retained earnings account.

Step 4: Transfer Balance

Any remaining balances will now be transferred and a post-closing trial balance will be reviewed.

Summary

Closing entries are an important facet of keeping your business’s books and records in order. By maintaining your bookkeeping, you can ensure that you are constantly kept informed. As well as being consistently up-to-date on the financial health of your business.

FAQs on Closing Entries

Only three accounts need closing:

- Revenue

- Expense

- Dividiends paid

There are three accounts that are never closed:

- Balance sheet’s assets

- Liabilities

- Owner’s equity

The month-end close is when a business collects financial accounting information. They review it and reconcile the records each month.

The year-end closing is the process of closing the books for the year. This involved reviewing, reconciling, and making sure that all of the details in the ledger add up.

Share: