Price-To-Book Ratio (P/B Ratio) Definition, Formula & Calculation

There’s a lot that goes into valuing stocks and determining their overall financial performance. Investors and analysts have lots to consider so they can make the best possible decisions. Having all the relevant information, including about market prices, helps with making better investment decisions.

There are certain ratios and financial metrics that they will commonly use to find out this information. One of the most common is the price-to-book (P/B) ratio. Companies also use it to compare their book value to their market capitalization. So what exactly is it and how does it work?

Keep reading our guide to learn everything you need to know about the price-to-book ratio (P/B). We’ll also cover the formula that’s used and a sample calculation!

Table of Contents

KEY TAKEAWAYS

- Using the P/B ratio analysis helps measure the valuation that a company has in the market in relation to its book value.

- The P/B ratio gets used by investors to identify potential valuable investments.

- Having a P/B ratio that’s under 1 will typically indicate that the investment is solid.

What Is the Price-to-Book (P/B) Ratio?

The price-to-book ratio (P/B) is a key financial metric that’s used to compare the book value of a company with its market capitalization. You can calculate the P/B ratio by simply dividing the stock price per share of a company by its book value per share (BVPS). The book value is the value of a tangible net asset that a company has. This gets calculated by taking the total assets and subtracting intangible assets, like goodwill or patents.

It’s also equal to the carrying value that’s on a balance sheet. Companies use this information to calculate the asset compared to its overall accumulated depreciation.

When looking at the first component of an investment, the book value can also sometimes be the gross or net of expenses. These can include things like service charges, sales taxes, and trading costs. It’s also worth noting that the P/B ratio can sometimes get referred to as the price-equity ratio.

How to Calculate the Price-to-Book (P/B) Ratio

To keep things simple, the book value is going to be equal to the current market value of a company divided by the book value of its shares. To get all the information you need, you’ll need to take a close look at the balance sheet of the company.

It’s also known as stockholders equity or shareholder equity, and it will be equal to the company’s assets minus its liabilities.

Here are the steps to follow to get everything you need to calculate the P/B ratio.

- The first thing you’re going to do is calculate the book value. This is done by subtracting a company’s assets from its liabilities.

- The second thing you need to do is find the book value of a company on a per-share basis. This is done by dividing the book value you found in step one by any and all outstanding shares.

- The final step is to divide the current stock price of the company by the book value per share that you found in step two. You do this by dividing the share price by the book value per share to find the price to book ratio.

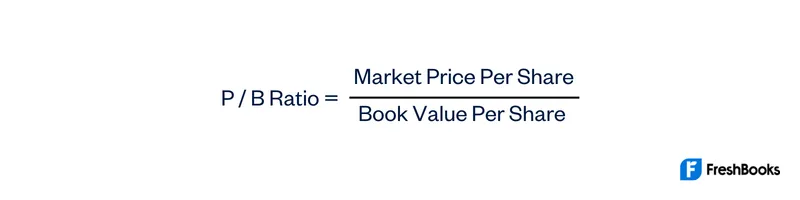

The formula for calculating the P/B ratio would look like this:

Example Calculation of the P/B Ratio

Let’s say that you want to find the P/B ratio for XYZ company to find their stock market price. After some research, you have found the important information you need to know. You have determined that the company has:

- Total assets of $2 billion

- Total liabilities of $1 billion

- 90 million outstanding shares

- A share price that’s currently at $12 per share

Following the steps outlined above, the first thing you will do is determine the book value. Subtracting the liabilities from the assets would leave you with a book value of $1 billion.

Then, you would divide that $1 billion by the 90 million outstanding shares. This would then give you a per-share book value of $11.11.

Finally, you divide the current price of $12 by the per-share book value. Ultimately, this would give you a price-to-book ratio of 1.09.

It’s worth mentioning that using the price to book isn’t always a useful metric for evaluating some businesses. For example, if a business has mostly intangible assets, the price earnings ratio will likely be higher than needed.

This can be common with technology companies. So, to get the most accurate and complete valuation ratios of a company, you can combine them with another metric. One of the best profitability metrics to combine it with is the return on equity (ROE) ratio.

Summary

Many companies use the price to book value ratio to help compare their market size with their book value. It’s relatively easy to calculate and you can find most of the needed information in the financial statements of the company. All you need to do is divide the stock price per share by the book value per share of the company.

The P/B ratio can work for a single company, a public company, and even for the biggest companies. It’s an effective company analysis and financial valuation metric. However, the measure of valuation might depend on the specific type of company and the industry in question.

Frequently Asked Questions

Usually, having any P/B ratio that’s under 1 is considered to be good, as it indicates they could be undervalued stocks. That said, many value investors consider a P/B under 3 to be worth looking into.

Having a higher P/B ratio typically means that the company’s stock price is trading higher compared to its book value. For example, a company with a P/B value of 2 means its stock is trading at twice its book value.

A lot of this is going to depend on the type of company and the industry that it’s in. Having a P/B ratio less than 1 might suggest the market is valuing the company at less than its value of assets.

The P/B ratio is a way to compare a company’s market size with its book value. The price-to-book value is part of the calculation required to find the price-to-book ratio.

Share: