Monthly Financial Reports: What Are They And How to Read

Updated on March 28, 2019 | 9 min. read

Financial reporting isn't only beneficial at tax time. By looking at daily, weekly, or monthly financial reports, you and your external stakeholders—including shareholders, investors, and lenders—can better understand your company's current and future financial status.

Comparing these reports from week to week or month to month reveals financial trends that might indicate problems in your business that need to be addressed or areas of opportunity. It can also show you what's contributing to profitability so you can double down on it.

But which financial reports should you review monthly versus daily, weekly, or annually? Let's examine the most important monthly financial reports for a business owner.

Here's what we'll cover:

What Is a Financial Report?

A financial report, also known as a financial statement, is a document that organizes and displays a business's financial information during a period of time or at a specific point in time.

Different financial statements illustrate different aspects of the business's finances. Each type of statement has its own specific financial statement format, designed to present information clearly and effectively. For example, a balance sheet shows what your business owns (assets) and owes (liabilities) and how much value you would be left with if you had to sell all of your assets to pay off those liabilities (equity). An income statement can show you how expenses are affecting your bottom line. If you're looking to improve your understanding of these formats, you can refer to our comprehensive guide on financial statement format, which covers the structure and presentation of various financial documents.

Financial statements can help you improve internal business performance by revealing important information or findings, like:

- Significant progress or changes to your financial position

- How you're generating cash flow

- Specific details of a business transaction

- Potential issues impacting your cash flow or profitability

- Whether you can pay off your debts

- Data you need to calculate key metrics, financial ratios, and demonstrate long-term profitability

3 of the Most Important Monthly Financial Reports for Small Businesses

The 3 most important monthly financial reports for small business owners looking to get a better understanding of their business are the balance sheet, income statement, and cash flow statement.

1. Balance Sheet

A balance sheet shows the financial position of a company as of a particular date. Balance sheets have 3 components: assets, liabilities, and equity.

For your balance sheet to be properly balanced, the total of your assets must equal the combined total of liabilities and equity.

To calculate the relationship between the 3 amounts, the business owner uses a simple equation:

For corporations:

And for sole proprietors and partnerships:

Reviewing your balance sheet monthly can help you gain a better understanding of the financial health and stability of your businesses. It can also help you make sound decisions related to investments, loan repayments, collections, and more. By reviewing your balance sheet every month, you can identify trends that may be leading to cash flow problems and take corrective action right away. You can also compare the current month's balance sheet with the previous one in order to track progress toward goals and make any necessary adjustments.

2. Profit and Loss Statement (Income Statement)

A profit and loss statement is a business report that shows your business's revenues and expenses and how much profit or loss you made for a specified period. In some cases, this report is referred to as an income statement.

By looking at your income statement, you can gain insight into your business's profitability and identify areas for improvement.

For example, your income statement might show your net sales, calculated as the amount of revenue earned over the reporting period after accounting for returns, allowances, and discounts. It also shows your cost of goods sold (COGS)—the materials and labor needed to make whatever it is your business sells. Net sales minus COGS is gross profit. If your COGS is creeping up but your net sales figure remains flat, you may need to increase prices or look for ways to cut costs in order to remain profitable.

Reviewing this monthly financial report can help you better manage your business profit and stay on track with goals.

Also Read: How to Prepare an Income Statement

3. Cash Flow Statement

A statement of cash flows shows every single incoming and outgoing cash transaction and how you spend and earn your money over a certain time period.

This statement takes a business’s net income (from the income statements) and adjusts it for any non-cash transactions included in net income, such as accounts receivable, accounts payable, and depreciation and amortization expense.

The cash flow statement breaks all cash transactions into 3 categories:

- Cash flows from operations: Business functions needed to operate, including accounts receivable, accounts payable, and inventory.

- Cash flows from investing: Equipment depreciation, acquiring or selling assets, etc.

- Cash flows from financing: Acquiring debts or repaying loans that don’t affect a company’s bottom line, but they do affect the amount of cash in the bank.cash flows from operations, cash flows from investing, and cash flows from financing activities. or financing activities to give a better idea of what happened to a company’s cash during that period.

Your cash flow statement provides a comprehensive view of how your business operates, where it’s making money, and how to make choices about cash management. Lenders and potential investors may also want to review your cash flow statement when deciding whether to invest in your business or loan you money.

Reviewing your cash flow statement monthly can help you spot any potential cash management problems and make corrections before they become too serious.

5 Things to Look for in Monthly Financial Reports

Financial reporting can be overwhelming. There are so many numbers to consider. What are the most important data points you should be looking at to help your business grow?

1. Your Bottom Line: Profit

Where to find it: Income Statement (Profit-and-Loss Statement)

A great place to start is your bottom line. To find out how your business is doing, check your net income on your profit and loss statement. This will tell you how much money your company has earned after paying for all expenses.

Next, spot any trends. Have those numbers gone up, stayed flat, or gone down? Understanding these trends can help you forecast your future profit.

For your business to be sustainable, you need to be able to pay yourself, pay your employees, and pay other bills that keep your business running. The best way to do this is to stay focused on the bottom line.

2. Business Expenses

Where to find it: Income Statement (Profit-and-Loss Statement)

If your business is growing, but you’re not taking home money, there’s a problem. Often, the problem is that your expenses are growing faster than your revenue.

One way to avoid this problem is to keep track of your expense trends. On your profit and loss statement, look at the line for total expenses. Then evaluate how your expenses have changed over the last 12 months (using past profit and loss reports). Compare that with trends in total revenue to discern whether there's any correlation.

Sometimes it makes sense for expenses to be higher than revenue. For instance, if you're buying new equipment or hiring employees. But if the expenses are not intentional investments to help your business grow, you may need to reign in spending or increase revenue.

3. Accounts Receivable

Where to find it: Balance Sheet

Accounts receivable is what's owed to you from customers—usually either goods purchased on credit or unpaid invoices for services you've provided. Use your balance sheet to find the total in accounts receivable. How much of your revenue is tied up in that figure?

You may be able to improve your cash flow by following up with clients to pay these invoices and improving your payment workflows to get paid faster moving forward.

4. Liquidity

Where to find it: Balance Sheet

Liquidity measures how easily you can convert assets into cash or use them to pay off debts. A liquid asset is one that can be quickly converted into money, such as cash or marketable securities like stocks and bonds. In contrast, illiquid assets like real estate and cars cannot be quickly converted into money quickly.

Liquidity is a key metric for small business owners because it makes it easier to meet short-term needs and manage cash flow. It can also allow you to take advantage of investment opportunities when they arise. If your business has a healthy amount of liquidity, you're better positioned to withstand financial crises and unexpected expenses.

You can use your balance sheet to calculate liquidity ratios:

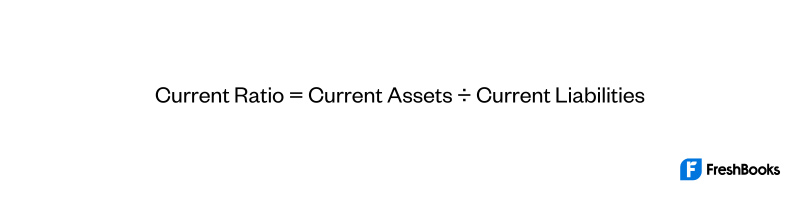

- Current Ratio: The current ratio measures your ability to meet short-term financial obligations with current assets. A higher ratio indicates more liquidity, while a lower ratio suggests that your business may have difficulty meeting its short-term financial obligations.

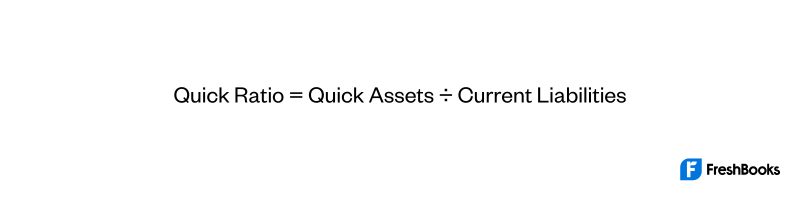

- Quick Ratio: The quick ratio measures your company’s ability to meet its obligations without relying on inventory. You calculate your quick ratio by dividing all "quick assets"—typically cash, marketable securities, and accounts receivable—by your current liabilities.

By monitoring liquidity and adjusting investments accordingly, you can help ensure you always have access to the necessary funds when needed.

5. Tax Liabilities

Where to find it: Income Statement (Profit-and-Loss Statement)

Being aware of your potential tax obligations can help you avoid penalties and ensure that you're only paying only what you owe.

Reviewing your income statement on a monthly basis can help you estimate your tax liabilities. Because this statement shows your total income, deductions, and net income or loss for a given period, you can apply your expected tax rate to your bottom line to get an idea of how much you might owe or how much you should pay in estimated taxes.

Auto-Generate Your Monthly Financial Reports

Generating monthly financial statements is time-consuming. Online accounting software does the heavy lifting for you—automatically pulling in data from your invoices, payments, and expenses and presenting it in a digestible and visually appealing way. Crucially, it also reduces potential errors in your reporting.

With financial reporting software, you’ll have all your financial reports at your fingertips whenever you or your stakeholders need them for at-a-glance temperature checks of your financial health, evaluating performance, and planning for the future.