When it comes to your small business accounting the more resources you have available, the better.

Keeping track of assets, earnings, and expenses in an organized manner will get you through the complicated tasks of your accounting period. Learn the different types of balance sheets, and how keeping an unclassified balance sheet can help you manage your expenses.

Classified vs. Unclassified Balance Sheet: What's the Difference?

There are many accounting methods to implement into your bookkeeping strategy. Keeping a balance sheet of your business liabilities is a necessary procedure for all entrepreneurs. In order to understand unclassified balance sheets, we must first define what a balance sheet is, and the several different types that make up the accounting equation.

What Is a Balance Sheet?

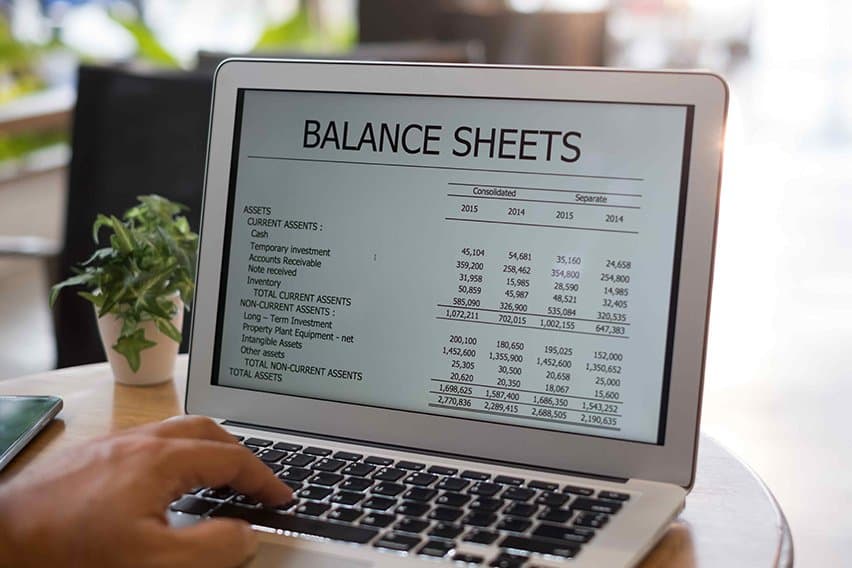

A balance sheet is a statement of a business’s assets, liabilities, and shareholders' equity. Balance sheets offer a snapshot of your business assets and any debts that it owes, as well as the amount invested by the owners.

A balance sheet tells you a business’s worth at any given time.

What’s included on a balance sheet:

- Assets (current assets, long-term assets, liquid assets)

- Liabilities (long-term loans, deferred income taxes and pension fund liabilities)

- Shareholders' equity (net assets)

What Is a Classified Balance Sheet?

Investors and creditors will typically request a classified balance sheet. This is a common balance sheet that splits the asset and liability accounts into categories. These categories include current assets, noncurrent assets, fixed assets, current and noncurrent liabilities, and shareholder loans.

Classified balance sheets are important to investors and creditors because they’ll use the organized information to analyze the business performance and growth over time.

Essentially, a classified balance sheet is a balance sheet that has been detailed and categorized based on short-term and long-term liabilities.

What Is an Unclassified Balance Sheet?

An unclassified balance sheet is like a rough draft financial statement. Business owners and accountants will draft out an unclassified balance sheet before categorizing the assets and liabilities.

Balance sheets that are unclassified provide the same information as a classified balance sheet, just uncategorized.

These balance sheets are typically for internal accounting purposes, as investors and creditors won't be able to see which liabilities are due in the next year or how many current assets are available. However, unclassified balance proves to be a resource for many bookkeepers and business owners to gauge performance and business standings.

Unclassified balance sheets are quick to draft up and can provide easily accessible information for balance sheet accounts.

Classified vs Unclassified Balance Sheets

As you’ll find in your accounting practice, both variations of balance sheets will be resourceful for your accounting procedures.

An unclassified balance sheet will lay out all of the information you’ll need to categorize and deliver to investors in the form of a classified balance sheet.

You can reference and add to your unclassified balance sheet throughout the accounting period, and eventually implement the changes into the finalized balance sheet. Both play a vital role in your accounting equation.

Using Unclassified Balance Sheets

Drafting up an unclassified balance sheet is a fast and simple way to get all of your income statements, financial reports, and expense accounts all in one place, and then use that information to separate categories of assets for that accounting period of time.

Unclassified balance sheets make it easy to access all of your short-term and long-term financial reports all in one place.

While unclassified balance sheets do not subtotal or group accounts into categories, they are used to reference short-term and long-term assets and liabilities:

- Balance sheet accounts document your business assets, current liabilities and accounts payable at any period of time

- Assets include; current and noncurrent, fixed assets, term assets, intangible assets, and liquid assets

- Show operating expenses, expense on loans, and debt to creditors

- Give quick access to equity balances and financial performance

- Create comparative balance sheets to gauge performance

Laying out all of these financial reports in an unclassified balance sheet will relieve you of the stress of trying to collect all of the information from different sources. You can use a balance sheet template to consistently input liabilities and assets, so they’re all in one financial statement for that accounting period.

Takeaways

A balance sheet offers a snapshot of your business assets and any debts that it owes, as well as the amount invested by the owners.

An unclassified balance sheet lays out uncategorized short-term and long-term liabilities. Businesses use unclassified balance sheets to get fast and easy insight into their business performance.

- While unclassified balance sheets do not categorize assets and liabilities, they provide quick access to general business financials, and can act as a rough draft when creating classified balance sheets to provide investors and creditors.

- Business owners should draft up unclassified balance sheets to state their current assets, liabilities, and shareholder equities-- and use this document to gauge performance and business standings.

- You can find balance sheet templates that suit your business accounting needs, so you can easily access your current operating expenses, cash inflow and liabilities from assets.