EBITDA Margin: Definition, Formula & Calculation

When investors compare different companies they look at specific financial terms and operating performance metrics to gain additional insights. For example, they’ll look at how efficiently a company operates and how much of its earnings come from operations. They could also look at company financials, like income margin, and revenue of companies.

There can be several performance metrics that highlight key pieces of data, and the EBITDA margin is one of these metrics. So how exactly does it work and what do you need to know to make more informed decisions?

Keep reading our guide to learn everything that you need to know about EBITDA margin. We’ll cover what it’s used for and how to calculate it yourself.

Table of Contents

KEY TAKEAWAYS

- The EBITDA margin is a type of performance metric that’s used as a measure of profitability based on a company’s operations.

- The primary focus is on the essential areas of a business, such as its cash flows and operating profitability. This shows insights into things like financial health and business valuations.

- To calculate the EBITDA margin, you simply divide the EBITDA by the company’s revenue.

What Is EBITDA Margin?

The EBITDA margin is an essential metric that investors use to compare different companies within the same industry.

EBITDA stands for earnings before interest, taxes, depreciation, and amortization. When used in the EBITDA margin, it provides insight into a company’s efficiency and operating profitability.

Non-cash expenses like depreciation and amortization aren’t considered when calculating EBITDA margin. This makes it a good way to figure out how much cash is generated for every dollar of revenue earned. Plus, you can get a better sense of corporate performance surrounding core business activities and annual revenue.

It’s crucial to understand the EBITDA margin when it comes to buying or selling a business. These are core metrics for determining both the company’s current value and future potential. This information can be especially handy for public companies that want to highlight financial performance.

How Do You Calculate EBITDA Margin?

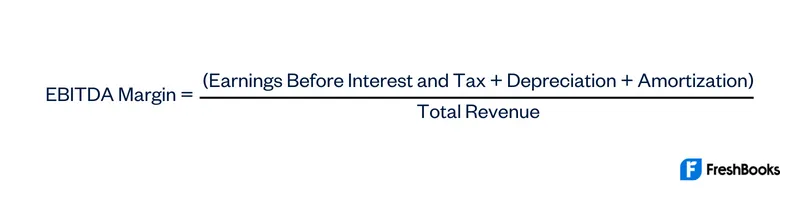

To calculate the EBITDA margin, the first step is to determine the EBITDA. You can do that by finding the earnings before interest and tax (EBIT) on the income statement. Then, add the depreciation and amortization expenses.

Here’s the formula for calculating EBITDA:

Knowing how to calculate it will give valuable insights into your current operational efficiency. If you find that your margin is too low, this gives you a hint to look for areas of improvement.

Let’s break down EBITDA further to learn what the calculation includes.

- Earnings refer to net income or the total revenue within an accounting period. In terms of EBITDA, earnings should come from core sales. It doesn’t take into account secondary revenue such as dividends or royalties.

- Interest and tax expenses come from the repayment of loans, funding, and corporate tax. EBITDA removes these expenses from the equation because it makes companies easier to compare to each other. This way, analysts can focus on how much money a company generates from its working capital.

- Depreciation and amortization refer to the value of an asset reducing over time. This is especially relevant to companies with a large number of fixed assets, such as machinery. These assets depreciate over time. Amortization means the spread of payments over time.

Both of these factors are added to the EBITDA calculation. This makes it a better gauge of overall profitability than just profit after initial expenses.

The EBITDA margin is calculated as a percentage. This shows the operating profit as a percentage of total revenue.

Example of EBITDA Margin Calculation

Let’s say company A has an EBITDA of $900,000. Their total revenue is $9,000,000. That would mean their EBITDA margin is 10%. The calculations would look like this:

10% = $900,000 / $9,000,000

Let’s say company B has an EBITDA of $1,000,000. Their total revenue is $12,000,000. That would then mean that their EBITDA margin is around 8%. The calculations would look something like this:

8% = $1,000,000 / $12,000,000

Let’s say a large corporation wants to acquire one of these two companies. While Company B has higher EBITDA and greater total revenue, its EBITDA margin is lower than Company A.

This might indicate that Company A operates more efficiently than Company B. Therefore, the corporation in question may see more potential in Company A and investigate its finances further.

What Does EBITDA Margin Tell Investors About a Company?

The EBITDA margin gives investors a sense of a company’s overall finances. Used in combination with other metrics, it offers insight into profitability and efficiency. Some of this information can come from a company’s financial statements.

These are two main factors that investors consider when comparing different companies. As a result, EBITDA margin is often used when planning mergers and acquisitions.

Here’s how the EBITDA margin is typically perceived:

High EBITDA Margin

A high EBITDA margin is generally considered more favorable than a low margin. It suggests greater profitability and stability. In addition, it can show how much operating cash comes from each dollar of revenue earned.

Low EBITDA Margin

Companies with a low EBITDA margin may have weaknesses in their business model. For example, they may be targeting the wrong market or have an ineffective sales strategy. This could result in cash flow issues or low profitability.

However, EBITDA isn’t useful for every situation. For example, it shouldn’t be applied when looking at a company with high debt capitalization. That’s because debt increases interest payments. These aren’t included in EBITDA margin calculations.

This also means it’s not necessarily the best way to estimate a company’s cash flow generation. For a more comprehensive alternative, investors can calculate Free Cash Flow instead.

Summary

The EBITDA margin can be helpful when combined with other forms of financial analysis. But it should always be taken in context and compared to industry averages and historical data. It’s one of the performance metrics for profitability.

When using the margin, it can show insights into things like operating expenses, company assets, and an overall company valuation. Plus, it can help with future accounting decisions and establish baseline profitability. You’ll be able to determine a simple difference between profit margins.

EBITDA Margin FAQs

The EBITDA margin is one of the metrics that investors use to compare different companies. It highlights the percentage of earnings that can be attributed to operations. This is helpful when it comes to mergers and acquisitions of small businesses.

Using EBITDA isn’t considered the best overall valuation method. That’s because a positive EBITDA doesn’t always mean a company is generating cash. EBITDA ignores changes in working capital and excludes interest on certain expenses like debt and taxes.

Both the EBITDA margin and operating margin measure a company’s profitability. However, they’re calculated differently. EBITDA measures a company’s overall profitability. It doesn’t always take the costs of capital investments into account. Operating margin measures profit after paying these variable costs. But before paying taxes or interest.

Generally speaking, a 10% or higher EBITDA margin is good. However, this number may vary significantly according to market and industry. Therefore, the EBITDA margin is only helpful when comparing companies within the same industry.

EBITDA is not one of the accounting terms in the generally accepted accounting principles (GAAP). That means there is no standardized approach and companies may use their calculations differently.

Share: