Free Invoice Template

Send tailored and polished invoices to your customers using Invoice Templates, a fast, easy, and free way to simplify your invoicing needs.

Download Free Invoice Template

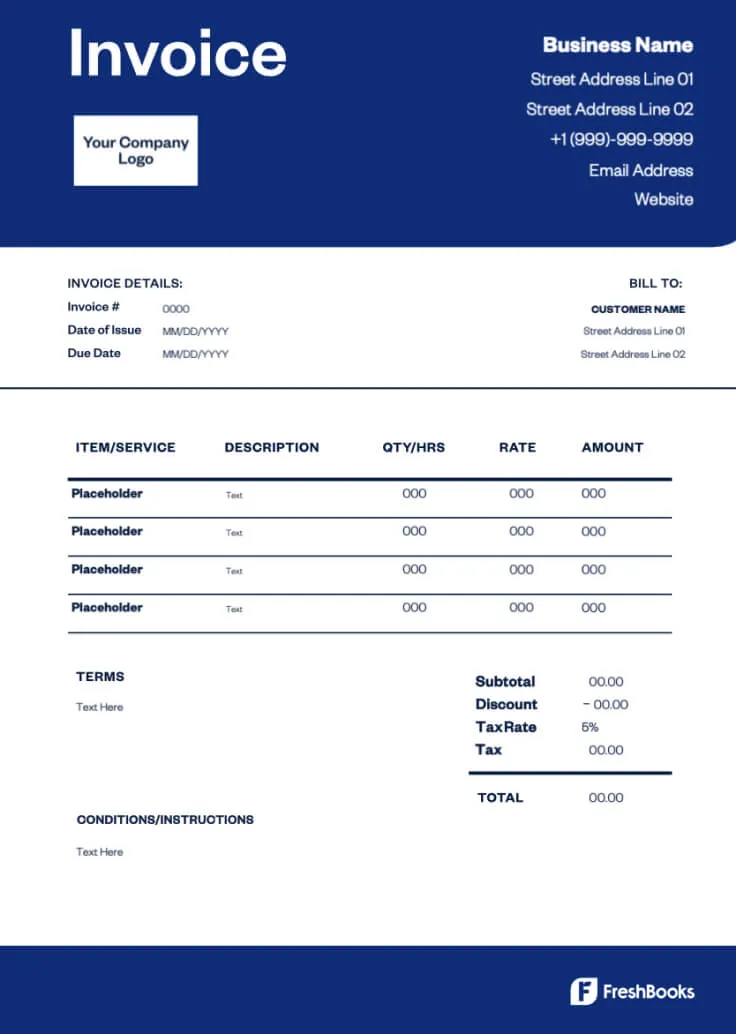

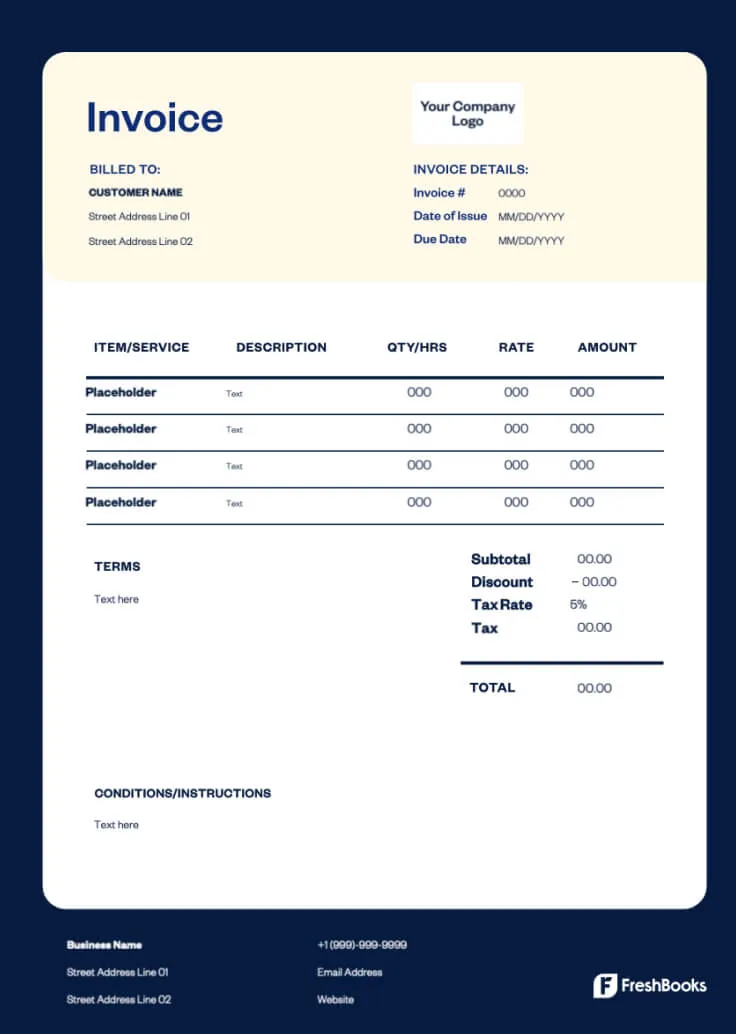

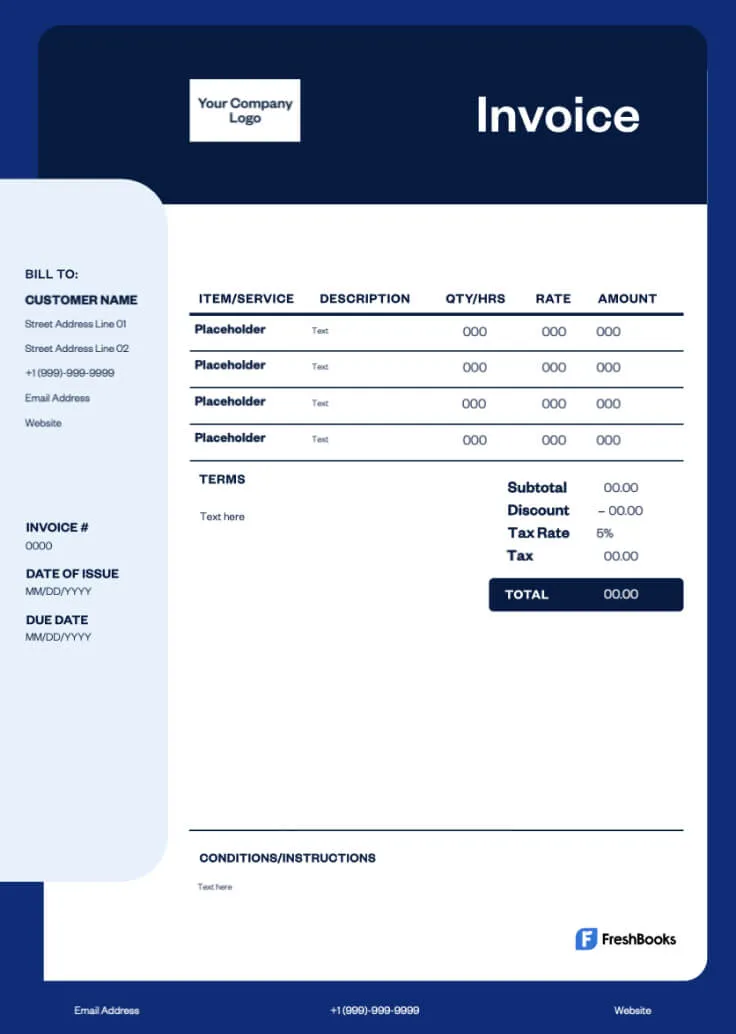

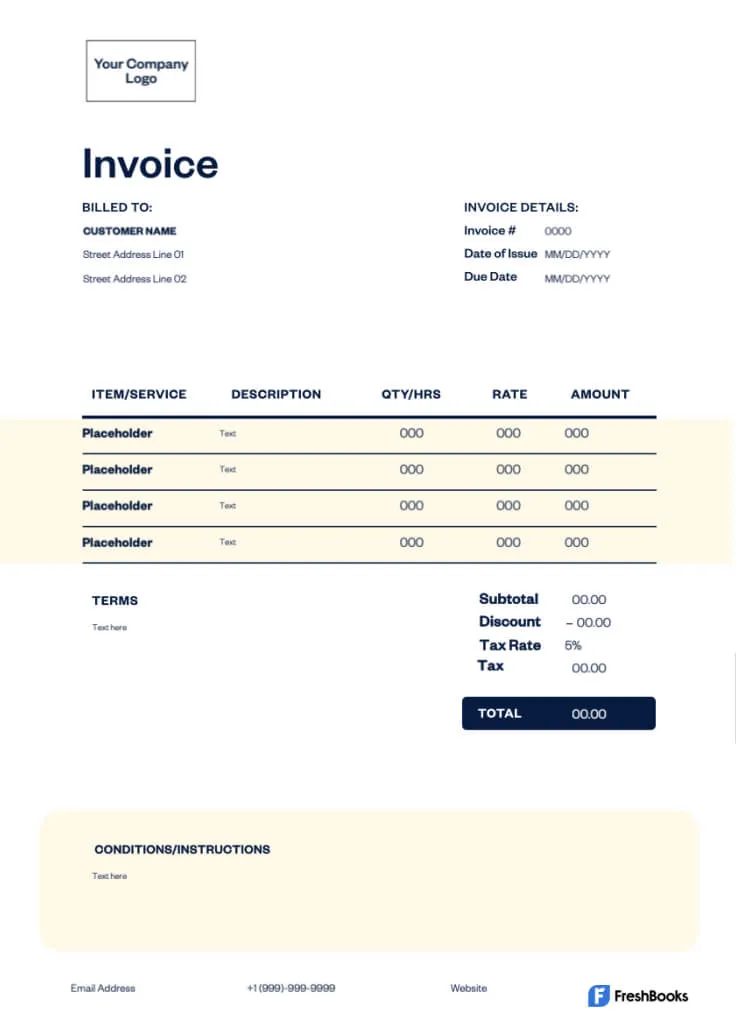

The FreshBooks Invoice Templates are a perfect solution for business owners who need to send out invoices quickly. Our professional invoice templates are tailored to increase brand recognition and give clients a professional experience. Want to see it in action? Try our Invoice Templates for free, or scroll to explore more templates based on format types or industry.

Choose a style

Free Invoice Generator

Try FreshBooks free invoice generator, and you’ll see how easy it is to create, download, and send tailored invoices in minutes—no sign-up required. If you like how much time you save and how professional your invoices look, sign up for a free trial now and experience our full suite of invoicing and accounting features.

Template Formats Based on Your Business Needs

FreshBooks Online Invoice Templates are available in all of the most popular formats. Choose one of our free downloadable invoice templates, and start creating your own custom invoices today.

Template Formats Based on Your Business Needs

FreshBooks Online Invoice Templates are available in all of the most popular formats. Choose one of our free downloadable invoice templates, and start creating your own custom invoices today.

Excel Invoice Template

Excel’s easy-to-use formulas make Excel Invoice Templates ideal for businesses that need to itemize a large number of products or services.

Word Invoice Template

Microsoft Word Invoice Templates are ideal for businesses that want to create highly branded invoices with images, colors, and other tailoring.

Google Sheet Invoice Template

Google Sheet Invoice Templates make quick work of creating Excel-style invoices in easily shareable Google Sheets.

Google Docs Invoice Template

Similar to Word Invoice Templates, Google Docs templates offer more freedom for design tailoring.

PDF Invoice Template

Portable Document Format (PDF) invoices can be password protected, making them extra secure. Our PDF Invoice Template is professional-looking and easy to tailor.

Free Online Templates For Related Businesses

Trades & Home

Whether you work in construction, home improvement, or as an HVAC contractor, the Trades & Home Invoice Templates make it easy to break out details and bill for labor and materials.

Legal

Our Legal Invoice Templates let you choose between invoices with hourly billing or fixed-rate invoices so you can customize your billing to best suit your legal practice.

Marketing & Creatives

Choose between hourly and fixed-rate billing—perfect if you work in a creative field with different project scopes and billing terms.

Business

Give your business an effortlessly professional touch with FreshBooks Business Invoice Templates. Tailor them with your colors and logo to build your brand.

Generic/Misc

Provide a detailed record of the goods or services sold with a variety of FreshBooks Invoice Templates for your business’s specific needs.

Medical

Find peace of mind with FreshBooks detailed Medical Invoice Templates that ensure accurate billing and easy payment processing.

Auto

Our itemized Auto Invoice Templates guarantee transparency and accuracy in every transaction and provide a clear, detailed record of services rendered.

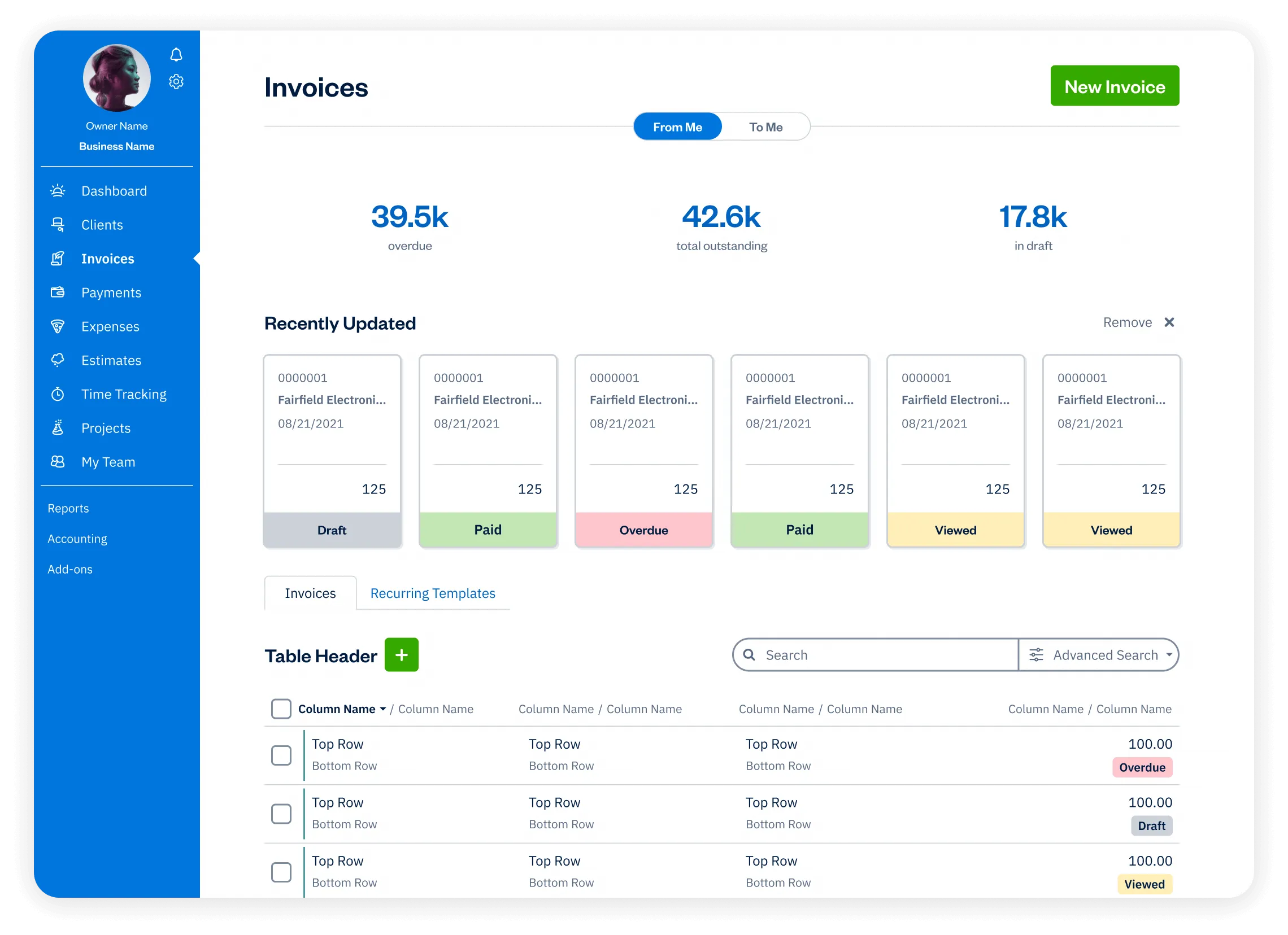

Free Invoice Templates vs. FreshBooks Invoice

Free invoice templates allow you to streamline your billing process quickly and easily, but FreshBooks lets you take it to the next level. Our comprehensive invoicing and accounting software offers automated and customized invoicing, faster online payments, and time tracking to simplify your bookkeeping and accounting tasks.

Downloadable Invoice Template

VS

FreshBooks

Features

Free Invoice Template

Flexible invoice templates

Printable formats

Email invoices at no cost

Accept payments on invoices

Schedule invoices

Automate payment reminders and late fees

Manage paid and outstanding invoices

Set up deposits for projects

Add discounts and credits to invoices

Automate recurring subscription invoices

Create and send invoices via mobile devices

Access your invoices FOREVER on the cloud 🔥

Sign up for a free FreshBooks trial today

Try It Free for 30 Days. No credit card required.

Cancel anytime.

Invoices 101: Helpful Invoicing Resources

FreshBooks Resource Hub has a wealth of informational and educational resources to help you stay organized and make informed decisions about your business. Check out our primers on invoicing basics, plus in-depth guides for specific needs like tax deductions for small businesses or invoicing as a consultant.

25 Small Business Tax Deductions To Know in 2023

How to Invoice as a Consultant: Accounting Tips for Consulting Businesses

How to Keep Track of Business Expenses: 3 Easy Steps

How to Estimate House Cleaning Jobs: A Pricing Guide

How to Do Accounting for Small Business: Basics of Accounting

10 Best Construction Estimating Software: Free & Paid

Frequently Asked Questions

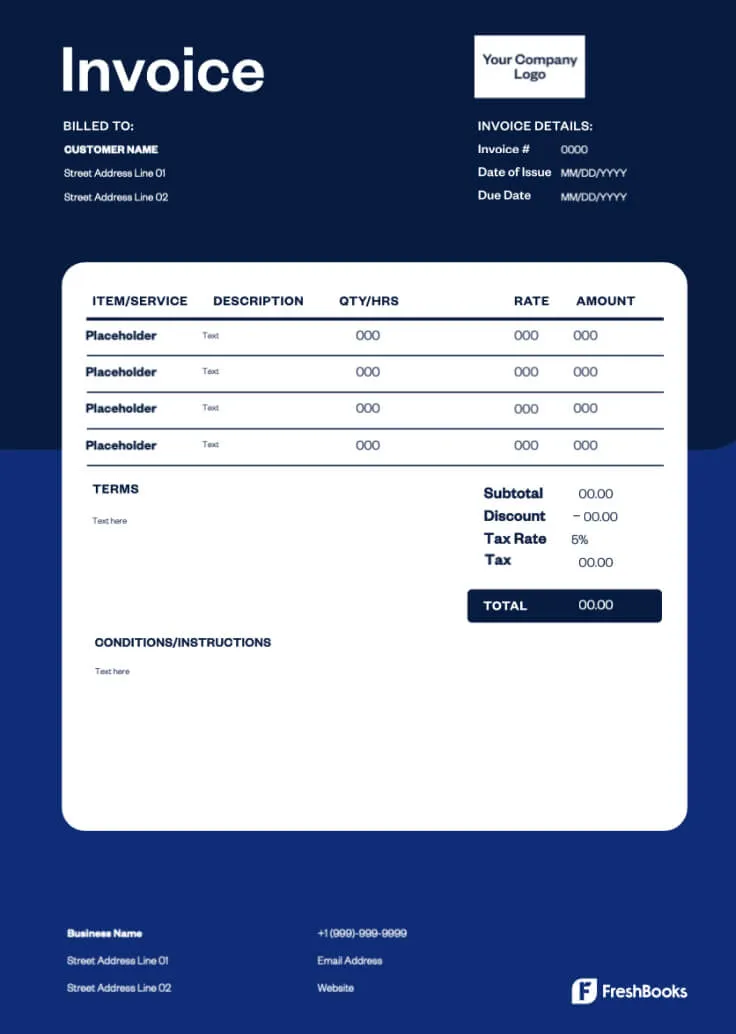

An Invoice Template is a pre-designed invoice layout with fillable fields. Simply enter the pertinent information, and the template does the math for you. Invoice Templates enable businesses to create invoices quickly and efficiently and streamline their operations. Our templates are easily tailored so that you can show off your brand logo and colors.

An Invoice Template has fields where you input your company’s name and contact information, your client’s name and contact information, an invoice number, a description of the products or services provided, the total cost, the date of the invoice, the payment due date, and any additional information you wish to include, such as terms and conditions or a personal note to a special customer.

To send an invoice, download the completed invoice to your computer. Then, you can email it to your customer, print it and send it via post, or both. To ensure efficiency and get paid fast, you can also use FreshBooks. FreshBooks makes small business invoicing and billing simple with features like Automated Recurring Invoices, Payments, Payment Reminders, and Retainers. Once you enter the necessary information into the platform, the software generates the invoice and sends it to the customer. They can check out the invoice on the portal or their email.

Yes—our Invoice Templates can be tailored to suit the needs of nearly any type of business, from retail to consumer packaged goods brands and contractors to consultants in virtually any industry. Our Invoice Templates are designed to be versatile and flexible so that you can display your brand’s logo, colors, and more.

Creating an invoice for your small business is easy with an Invoice Template. Choose the type of template that works best for your needs, and tailor it with the necessary information, including your and your customer’s name and contact information and the details of the products or services provided. Then, download your invoice, and send it via email—or print and mail it.

Every business has different invoicing needs. The best software is one that not only allows you to send professional, branded invoices but also integrates with your bookkeeping and accounting software to save you time and money. FreshBooks is an easy-to-use solution that allows you to send invoices in seconds while making it easy for clients to pay invoices. All while ensuring you are ready for tax time and clear on the financial health of your business.